Shaping the future

The Climate-Tech Imperative

February 28, 2023

Speaking at the Munich Security Conference on Friday, the European Union’s stony-faced climate chief delivered a grim warning to attendees: if the environmental crisis is not brought under control, parts of the planet will soon be uninhabitable — and societies will be sundered by conflicts over food and water. According to Frans Timmermans, there is no security without climate security, and, while there is a ‘nascent’ sense of urgency in society, governments and industry need to intensify their efforts to expedite the clean-energy transition. Countries now have just seven years to cut global emissions by 45% in line with the Paris Agreement; and every missed opportunity, it seems, ratchets up the risk of radical destabilization of the environment.

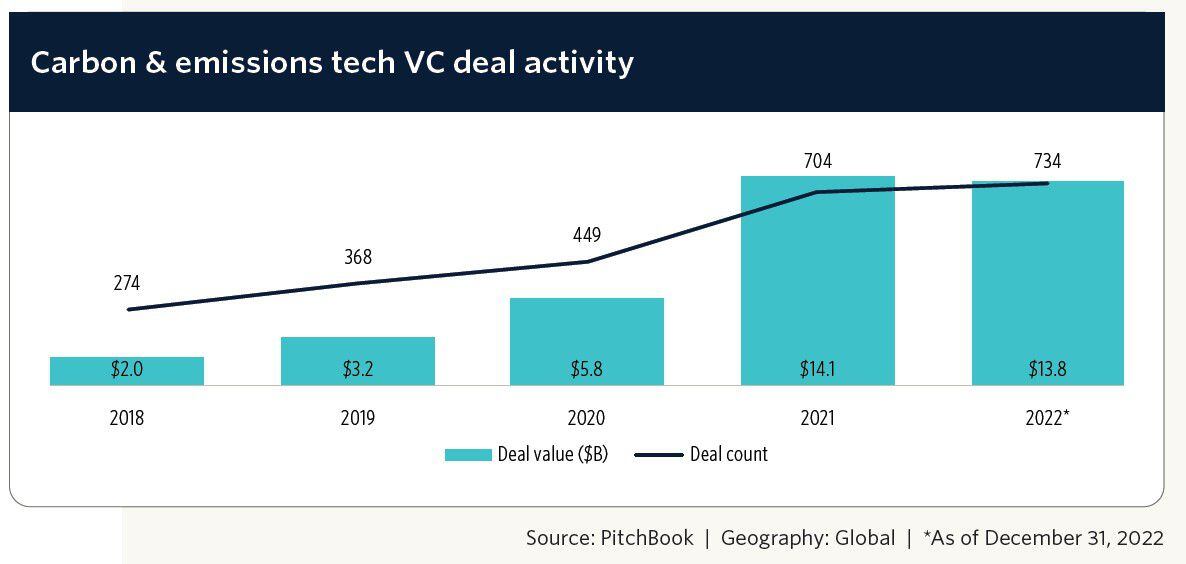

Now, as the International Energy Agency has noted, it will likely be impossible to meet such challenging emissions targets without deploying carbon-capture and storage technologies. And, as this realization sets in — and the investment opportunities become clear — venture capital is flooding into these critical solutions. According to new analysis from PitchBook, carbon- and emissions-tech startups have shown remarkable resilience during the tech downturn. Globally, they raised $13.8bn in 2022, which was only just short of the previous year’s total of $14.1bn.

One of last year’s notable carbon-tech success stories was the Swiss startup Climeworks, which has developed a direct-capture technology that removes CO₂ from the air. It raised $634.4mn in a Series F round. Another was UK-based Carbon Clean, whose scalable carbon-capture, utilization, and storage technology allows heavily polluting industries to reduce their emissions by up to 90%. It secured $150mn in Series C funding. And a third was Twelve, a Berkeley-headquartered startup which converts captured CO₂ into critical chemicals, producing only oxygen and water as outputs. It picked up $130mn in a Series B round. Combined, these three companies alone raised over $914mn last year; that amounts to almost 30% of the $3.2bn pocketed in 2019 by carbon-tech startups.

Analysts predict that this growth will continue apace. In the United States, for instance, the passage of the Inflation Reduction Act — a major piece of climate legislation — will ensure that, over the next decade, companies engaged in developing clean-energy technologies will receive $369bn in grants, loans, and tax breaks. This will stimulate further investor interest, with the 45Q tax credit amendment providing a huge boost for carbon-tech companies. These firms will now receive tax credits worth up to $180 for every ton of carbon they capture and store. According to Chatham House, the IRA, if fully implemented, will reduce US emissions by 40%.

However, given that this falls short of its commitments under the Paris accord, Mr. Timmermans is surely right that the US, along with other major economies, still needs to do more. But, with 91% of the global economy said to be covered by net-zero pledges, and the climate-tech industry flourishing (there are now at least 83 climate ‘unicorns’ worldwide!), it seems that a quiet optimism might not be wholly misplaced. So, while the warnings remain dire and the challenges formidable, it is to be hoped that timely mitigation strategies will help us to prevent the darkest climate predictions from coming to pass.